We recently published a blog describing the features and benefits of a Charitable Lead Annuity Trust (CLAT) and how current financial conditions have created an environment primed for new planning opportunities. In this posting, we are taking a deeper dive into the unique design and benefits of a Shark Fin CLAT, for those charitably inclined and eager to transfer wealth to future generations.

CLATs are split interest trusts, with the lead interest allocated to a charity for a term or for the grantor’s lifetime. The remaining interest is passed to the grantor’s chosen beneficiaries or are reverted to the grantor. Charitable lead interest can be level or increased during the duration of the trust. Different design features of a CLAT allow for different levels of deductions, lead interest and remaining interest to the chosen beneficiaries.

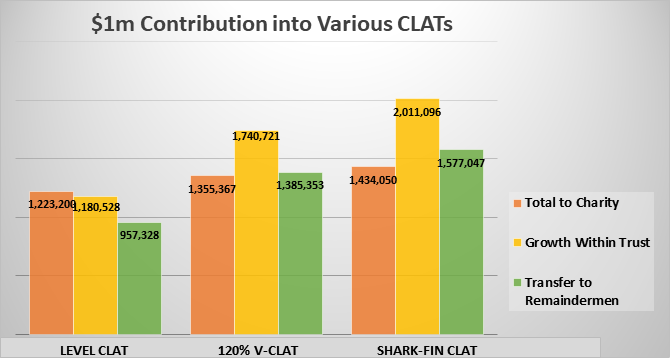

Below we have illustrated the differences in opportunities for wealth accumulation and ultimate wealth transfer amongst three CLAT structures. All scenarios noted below assume a 2% §7520 rate (as of 2/2020), a $1 million fair market value asset transfer into a Grantor CLAT, a 20-year CLAT maturity designed to “zero-out” and a 6% return on assets invested within the trust structure. One option is a Level Lead Interest, and the remaining two are a 120% increasing lead interest, and a Shark-Fin designed with low lead interest and substantial balloon interest at the tail end of the CLAT term.

The main takeaway from this chart is that the Shark-Fin CLAT scenario should transfer more wealth than the other less severely back-loaded annuity patterns. It is important to note the grantor trust classification of the CLAT since a non-grantor structure would be unlikely to yield similar results. In fact, because of the income tax liabilities on the gains generated on the assets within the Trust, the Shark-Fin structure would result in a smaller remainder value as compared to a variable CLAT scenario.

| Level CLAT | Variable CLAT (120%) | Shark-Fin CLAT | |

| Initial Contribution | 1,000,000 | 1,000,000 | 1,000,000 |

| CLAT Term | 20 Years | 20 Years | 20 Years |

| Charitable Deduction | 1,000,000 | 1,000,000 | 1,000,000 |

| Initial Annual Payment | 61,160 | 7,260 | 10,000 |

| Total to Charity | 1,223,200 | 1,355,367 | 1,434,050 |

| Growth Within Trust | 1,180,528 | 1,740,721 | 2,011,096 |

| Transfer to Remaindermen | 957,328 | 1,385,353 | 1,577,047 |

Section 642(c) of the Tax Code provides that the maximum income tax deduction allowable to a trust in any given year is the lesser of the taxable income of the trust and the payment to the charity for that year. As such, in years of low annuity payments within a non-grantor Shark-Fin CLAT structure, the trust could generate significant tax liabilities and tax drag on assets. Without any mechanism to carry forward unused charitable deductions, these deductions are wasted within the non-grantor trust structure and result in these lagging results.

Ideal Assets for Shark-Fin CLATs

This leads us to a more in-depth discussion on ideal assets for Shark-Fin CLATs and includes many of which were previously deemed unsuitable for CLATs:

- FLP interests holding Commercial Real Estate: Typically, cashflow producing properties are not ideal assets for CLATs due to risk of falling rental income but the back-loaded nature of Shark-Fin CLAT annuity payments allows for cashflows to accumulate over time and providing insurance against the risk for declining future income.

- Private Equity Interests: These were typically considered poor assets for CLATs due to their “J-curve” valuation nature. The ability to use rolling Shark-Fin CLATs mitigates the liquidity and valuation issues inherent in Private Equity assets.

- Preferred Investments in Family Limited Partnerships: The ability to discount the fair market valuation of the asset creates a built-in arbitrage. For example, consider a $10 million market value of preferred stock paying 8% preferred interest and assuming a 20% discount upon transfer into the CLAT. This would effectively increase the yield from 8% to 10% and create a 2% arbitrage each year.

- Concentrated or High-Volatility Stock Position: In some cases, the dividend alone can cover the annuity payment to charity, so long as it exceeds the §7520 rate. This would allow the asset time to realize explosive growth.

Grantor CLAT Issues and Guidance on Shark-Fin CLAT Structure

There is no specific guidance from the IRS about Shark-Fin CLATs and at least one author (“Validity of Shark-Fin CLATs Remain in Doubt Despite IRS Guidance,“ 37 Est. Plan J. 3 Oct. 2010) has raised concerns that the IRS may view a balloon payment at the termination of the CLAT as an abusive strategy and seek to limit the deferment of charitable payments. The argument centers around the preamble to final Treasure regulations on GRATs that state that allowing a “zeroed-out” GRAT, while effectively transferring all appreciated property through an end-term balloon payment is inconsistent with the principles of §2702. The authors do not point to any other specific rulings, regulations or court cases related specifically to CLATs and we would argue that a GRAT is a no-lose proposition to a grantor from an asset transfer standpoint. If a GRAT fails to transfer any appreciation out of the taxable estate, the donor is no worse off than before the transaction began. This is in marked contrast to a CLAT, which splits benefits between a charity and the grantor’s non-charitable beneficiaries and offers no option for asset redeployment in the event of less than expected remainder value.

It has been argued that Shark-Fin CLATs could be challenged based on the idea that the lead payments are too small to be considered measurable. Those who espouse this argument say it is supported by the idea that a de minimis requirement is applied to Charitable Remainder Trusts (CRTs), however CLATs do not impose a de minimis requirement like CRTs nor do they offer implied de minimis payments like GRATs as a result of the 20% annual maximum on increasing payments. This argument also ignores the fact that CRTs are offered tax-exempt status and the de minimis requirement is meant to ensure that trusts that are not truly CRTs are not afforded tax-exempt status.

The myriad of planning opportunities in this environment of low interest and asset valuation levels, combined with the unique benefits related to the design of a Shark-fin CLAT make this an excellent time to address estate planning.