Charitable Lead Annuity Trusts (CLATs) have been a favorable advanced estate planning technique among clients for years. CLATs are split interest trusts, with the lead interest allocated to a charity for a term or the grantor’s lifetime. The remaining interest passes to the grantor’s chosen beneficiaries or reverts to the grantor.

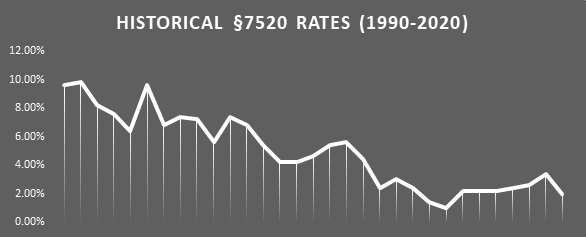

Due to the current economic environment, CLATs are a solid planning technique to consider for helping clients reach their advanced estate planning goals. The key reasons are: depressed asset valuations, and historically low 7520 interest rates (see below chart) and in certain circumstances, the use of a variable CLAT, which has increasing lead interest over time.

Those clients who are most likely to benefit from CLATs and are considered excellent candidates for this wealth transfer planning technique would be: charitably inclined (or considering establishing a Private Foundation); looking to transfer wealth estate tax-free; have a potential future liquidity events (e.g. sale of business) or have assets with a high probability of increasing value.

All other things being equal, a lower §7520 rate produces a higher present value for an annuity stream of payments and thus a lower present value for the remainder value. In the case of a “zeroed-out” CLAT, the design leads to a present value of the charitable lead interest equaling the value of the trust corpus, thereby eliminating any taxable gift to the remainder beneficiaries. The remaining value, which passes to the noncharitable beneficiaries, is the upside of the economic performance of the trust assets over and above the AFR rate on an estate tax free basis. Thus, in a low interest rate environment, the likelihood of trust assets outperforming the AFR “hurdle” rate is high which increases the value passing to the trust beneficiaries.

(Exhibit 1; Source: https://leimberg.com/freeResources/keyRates.html#history)

The conventional design of the lead interest in a CLAT is either level or steadily increasing (such as in a variable CLAT structure), while a Shark-Fin CLAT is so named due to the shape the annuity pattern takes when arrayed horizontally on a graph since the lead interest in the early years is extremely low, with quickly escalating payments towards the end of the CLAT term culminating in a balloon payment. (More about Shark-Fin Clat’s in our next blog.)

Conventionally structured CLATs fail for two main reasons, both of which can be mitigated through the introduction of a Shark-Fin CLAT design. First, if the assets within a “zeroed-out” CLAT are unable to outperform the §7520 rate, then there will be no remaining assets within the trust to transfer at the end of the term. With lower sustained annuity payments in the early years, assets with a more aggressive growth profile are ideal for Shark-Fin CLATs and, in theory, would increase the changes of outperforming the §7520 rate over the course of the CLAT term.

The second reason why CLATs fail is due to the sequencing of returns on assets. An average growth rate which exceeds the “hurdle” rate may not be enough to offset prolonged poor performance in early years and the fixed payments due to the charity. Consider the following example:

| Year | Return Path 1 | Return Path 2 |

| 1 | 10.10% | -22.10% |

| 2 | 1.30% | -11.90% |

| 3 | 37.60% | -9.10% |

| 4 | 23.00% | 21.00% |

| 5 | 33.40% | 28.60% |

| 6 | 28.60% | 33.40% |

| 7 | 21.00% | 23.00% |

| 8 | -9.10% | 37.60% |

| 9 | -11.90% | 1.30% |

| 10 | -22.10% | 10.10% |

| Average Growth Rate | 9.30% | 9.30% |

Although the average annual growth rate under both scenarios is identical, under a conventional CLAT structure requiring sizable annual annuity payments, you can see how the CLAT’s ability to remain viable would be under tremendous duress within the first few years and even see it running out of assets before the end of the term. Alternatively, the Shark-Fin CLAT design allows the trust assets more time to recover from poor returns before larger annuity payments are required.

The current market conditions provide a unique opportunity for those who are so inclined to engage in advanced planning. The confluence of depressed asset pricing, access to valuation discounts and low interest rate environment, specifically Section 7520 rates, present an exciting opportunity for planning discussions.